The Most Significant Point of Entertainment Aggregation in the Home

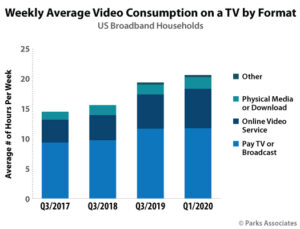

The nature of the smart TV business has changed. Smart TVs now embody the main focal point for content consumption at home, the collection of user data, and a source of recurring advertising revenue. Parks Associates research forecasts the smart TV installed base among US broadband households to have dipped slightly in 2021, as consumers gradually returned to more time outdoors after the pandemic lockdowns of the previous year. Additionally, supply chain issues in the technology sector resulted in shortages for consumers that would otherwise have purchased replacement or upgrade TVs.

As significant competition continues to take place between TV vendors going forward, smart TV adoption is expected to resume advancing upward by the end of 2022, albeit at a slower, steadier pace than that of the pandemic period — particularly as the supply chain bottleneck over the near term will sustain higher pricing.

As significant competition continues to take place between TV vendors going forward, smart TV adoption is expected to resume advancing upward by the end of 2022, albeit at a slower, steadier pace than that of the pandemic period — particularly as the supply chain bottleneck over the near term will sustain higher pricing.

There are a number of implications and resulting recommendations for stakeholders in the smart TV industry. These will differ depending on specific sector, and focus is given below to smart TV platform vendors, TV manufacturers, streaming services and content owners, and traditional pay TV operators.

Smart TV OS / platform vendors will need to leverage user data to create a long-term revenue stream, either through in-house efforts or partnership.

The smart TV’s position as the central point where linear, OTT, and gaming are all consumed, make it a crucial device for collecting data to help understand entertainment consumption and behavior. This data is potentially valuable for either measurement or advertising purposes, and can provide platform owners with an additional revenue stream. Some platform companies do not have the capital or desire to build up their own advertising/measurement teams and business units, but data can still be leveraged by engaging in partnerships with firms that possess the expertise to utilize the data. An example of this is the exclusive data-sharing relationship between VIDAA and Tremor International.

Smart TV manufacturers are currently evaluating the viability of developing a proprietary platform to capture advertising revenues.

Maximum control of a smart TV platform’s functionality, and its advertising and measurement revenue generation potential, requires ownership of the platform. The capital expenditure, time, effort, and staffing required to develop and maintain a smart TV platform, as well as its app ecosystem, is considerable. Due to this, only a small handful of manufacturers have thus far developed their own platform. TV manufacturers must decide whether the effort and investment of developing a new platform is justified by its potential revenue generation. For many manufacturers, working with a third party platform provider is a more realistic option with faster time to market.

Streaming services and content owners are working to tighten metadata and allocate budget for paid placement to stand out from the crowd.

Smart TVs are a point of aggregation for multiple OTT services as well as linear content. Additionally, smart TV UXs are trending towards aggregating even further to present a content-first, source-agnostic experience to consumers. Services wishing to stand out within this paradigm and ensure they are maximizing potential engagement with consumers will need to expend additional effort or budget.

Traditional pay TV operators know now that supporting smart TVs is a necessity and lessens capex on STBs.

The traditional pay TV industry is increasingly cost- and margin-constrained, as it attempts to reinvent itself in the face of subscriber losses. Many pay-TV operators have transitioned away from legacy set-top boxes and infrastructure, and instead rely upon inexpensive operator-managed streaming set-top boxes to deliver their video packages over the internet. The next step, already taken by many major pay-TV operators, is the deployment of full-featured apps for the top device for video consumption in households today – smart TVs. The definition of a pay-TV operator today can no longer be constrained to a particular footprint or infrastructure, and will need to leverage the scale available from consumers’ adoption of smart TVs into their video consumption lifestyle.

The companies controlling the smart TV platforms in use today are in control of the most significant point of entertainment aggregation in the home, and the most powerful players will leverage that as a significant source of recurring revenue in the years ahead.

For monthly updates on trends and market activities in the video entertainment space, please visit ParksAssociates.com.