CableCARD Report: 54 Million Deployments vs 618K Retail

The top 9 cable companies have roughly 54mln operator-supplied set-top boxes with CableCARDs currently deployed, NCTA said in its latest CableCARD report to the FCC Fri. That’s an increase of approx 1mln from late July when the trade group issued the last report. The number was 52.6mln in May and 51.5mln in Feb. By contrast, only a little more than 618K CableCARDs have been deployed in retail devices by the 9 largest incumbent cable MSOs. The 5 cable MSOs – Cablevision, Charter, Comcast, Cox and Time Warner Cable—have deployed more than 587K CableCARDs for use in retail devices. Looking at a few of the MSOs, Charter has a total number of 55K CableCARDs in service through Sept 30. Cox has a total of 57,735 residential CableCARDs in service, while TWC has more than 98K activated. Comcast has over 340K CableCARDs installed in active customer homes.

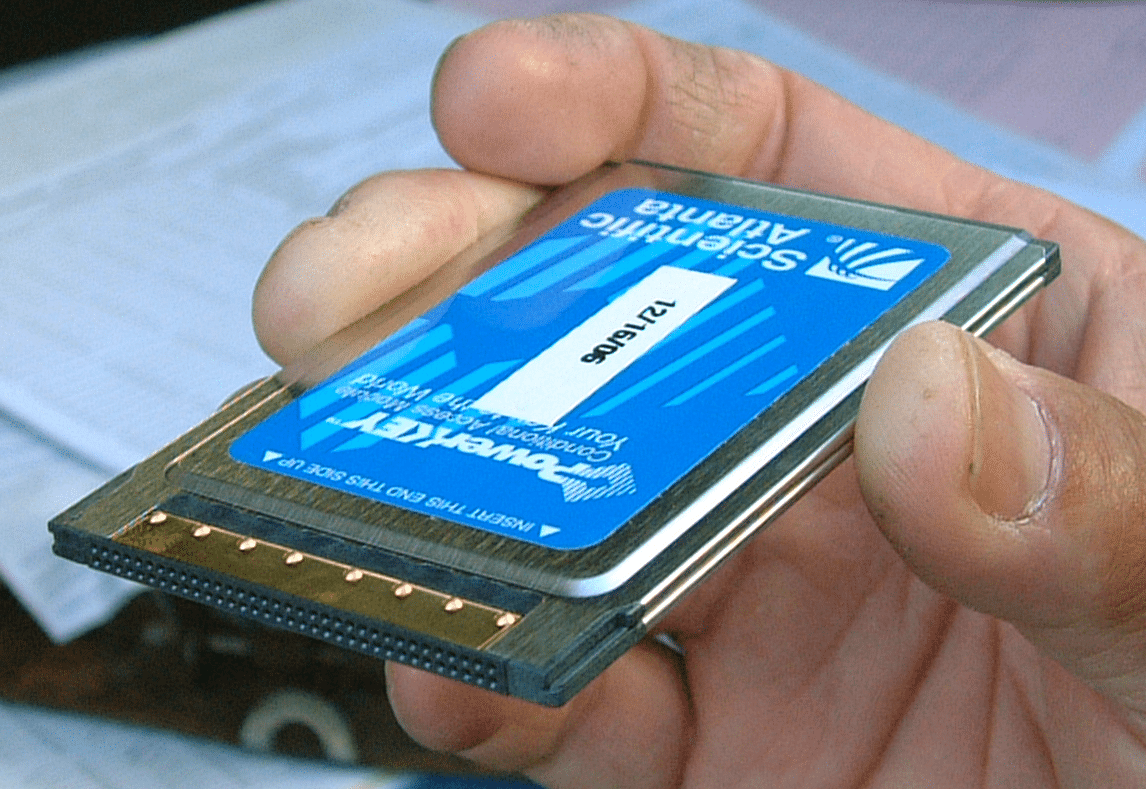

The NCTA report also summarized various CableCARD technology issues. At Comcast, its subs occasionally attempt to move a CableCARD from one device to another, creating service issues. “CableCARDs do not automatically work properly when moved to a different device as the Card and Host must be ‘paired’ in the headend control system. Comcast personnel and control systems are not equipped to handle moving CableCARDs in this manner so these situations require escalation to restore service in the new device. Comcast discourages this practice,” the NCTA report said. For Charter, CableCARD problems encountered this quarter were routine installation issues, which were resolved at the time of installation through Charter’s standard troubleshooting process. At TWC, problems include incorrect software/firmware on host devices, which are common across all device brands. NCTA has been filing CableCARD reports since the FCC’s integrated security set-top ban went into effect in 2007. The SELAR Act, which took effect last year, will sunset the current ban. The agency’s Downloadable Security Technology Advisory Committee (DSTAC) proposed several new technologies aimed at replacing the CableCARD standard, including an apps-based approach and an AllVid-style approach, which would require deploying additional hardware in ops’ networks or in subs’ homes to decode cable signals for 3rd party devices. Cable ops, in general, oppose the AllVid approach, saying it will cost customers billions each year as it requires more equipment, increasing energy consumption. Like ops, cable vendors such as Arris also support the apps-based proposal. Companies like Google back the AllVid approach. The Media Bureau recently sought comments on the final DSTAC report, with reply comments due Nov 9.